The Surprising Truth About Zebec Network Price Prediction

Let’s be honest: predicting cryptocurrency prices is a bit like trying to catch smoke. It’s incredibly difficult, and anyone who claims otherwise is likely selling something. But that doesn’t mean we can’t develop a smart, informed approach to zebec network price prediction. This isn’t about getting rich quick; it’s about making educated guesses based on available information. Ready to dive in?

Understanding the Zebec Network: More Than Just a Price Tag

Before we even think about zebec network price prediction, we need to understand what Zebec Network actually is. It’s a decentralized finance (DeFi) protocol built on Solana, focusing on salary payments and micro-payments. This unique focus sets it apart from many other cryptocurrencies. Instead of solely relying on speculative trading, Zebec’s value proposition is tied to its utility – a critical factor in long-term price stability.

The Importance of Real-World Utility

This brings us to a key point in zebec network price prediction: real-world adoption. The more companies and individuals use Zebec for payroll or other micro-transaction needs, the more demand there will be for the ZBC token, and likely, the higher the price will climb. Keep an eye on adoption rates and partnerships as crucial indicators.

Key Factors Influencing Zebec Network Price Prediction

Several factors influence zebec network price prediction, making it far from a simple equation. Let’s break down some of the most important:

Market Sentiment and Overall Crypto Trends

The overall cryptocurrency market is a huge influencer. A bullish market can boost nearly all cryptocurrencies, even ones like Zebec, while a bear market will likely impact it negatively. This is why keeping an eye on the broader crypto landscape is crucial.

Technological Developments and Updates

Significant upgrades, new features, or successful integrations within the Zebec Network can generate significant positive impacts on its price. It’s crucial to stay updated on their development roadmap.

Regulatory Landscape

Government regulations regarding cryptocurrencies can have a dramatic effect on price. Changes in regulatory frameworks can significantly impact investor sentiment and, consequently, the price.

Competition Analysis

Zebec Network isn’t the only player in the DeFi micropayment space. Analyzing its competitors and their offerings helps to assess Zebec’s relative strengths and weaknesses, influencing our zebec network price prediction. A competitor’s success can either steal market share from Zebec or spur innovation.

Practical Strategies for Zebec Network Price Prediction

So, how can we actually approach zebec network price prediction? It’s not about finding a magic formula, but rather employing a multi-faceted approach.

Fundamental Analysis: Digging Deeper

Fundamental analysis focuses on the underlying value of the Zebec Network. This involves analyzing things like their adoption rate, technological advancements, and the overall strength of their team. In my experience, this long-term view is crucial.

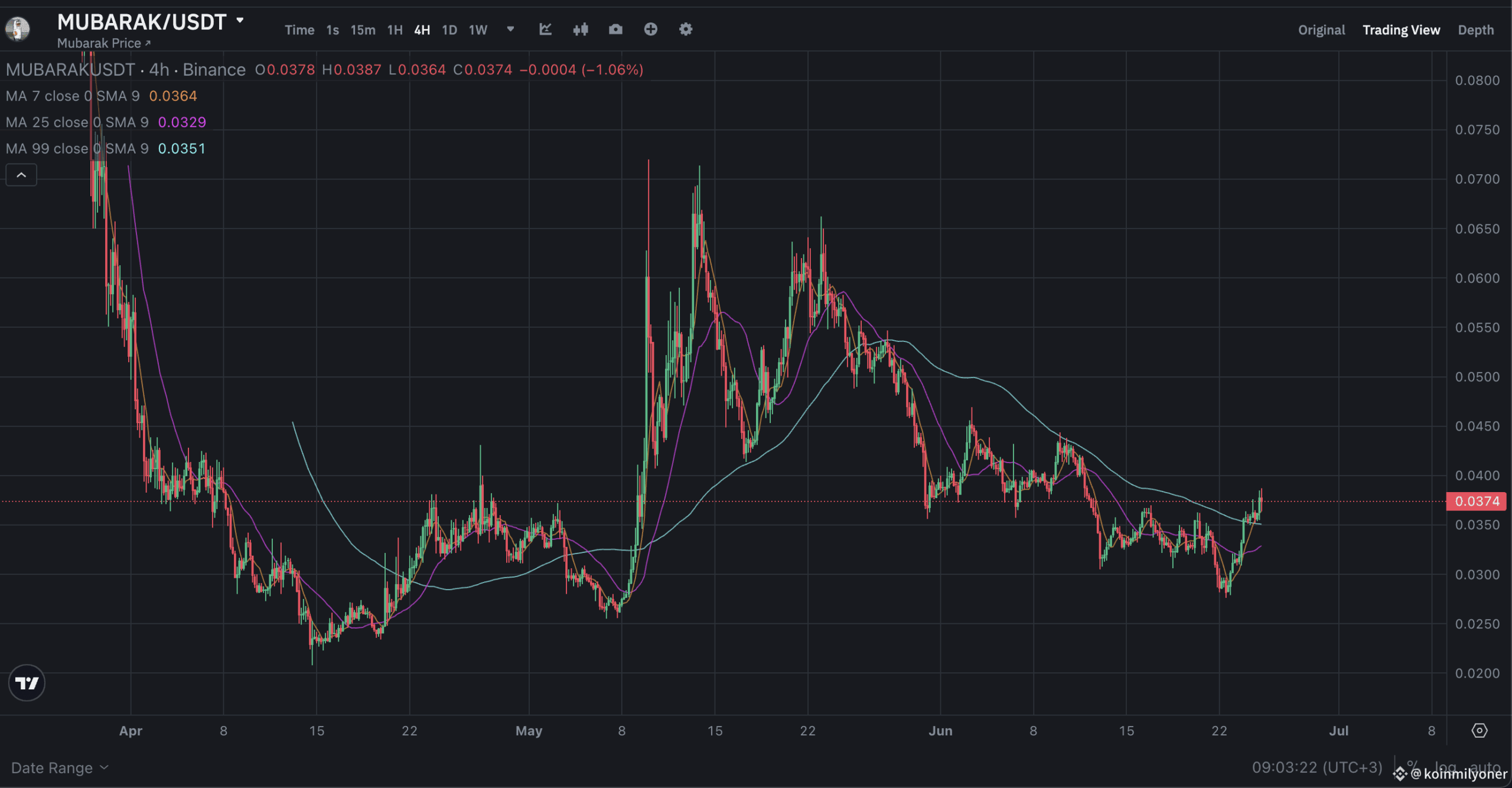

Technical Analysis: Charting a Course

Technical analysis utilizes price charts and indicators to predict future price movements. This involves studying things like trading volume, price trends, and support/resistance levels. While not foolproof, this approach can offer short-term insights.

Avoiding Common Pitfalls in Zebec Network Price Prediction

One thing to keep in mind is that zebec network price prediction, like any market prediction, is fraught with potential pitfalls. Let’s address a couple of the most common ones:

FOMO (Fear of Missing Out)

Don’t let FOMO dictate your investment decisions. It’s easy to get caught up in the excitement of a potential pump, but rational decision-making is key.

Overreliance on Predictions

Remember, no prediction is guaranteed. Treat any price prediction as a possibility, not a certainty. Diversify your portfolio and don’t put all your eggs in one basket.

Using Social Media Wisely

Social media can be a double-edged sword. While it can offer insights, it’s also rife with misinformation. Always do your own research and don’t rely solely on social media sentiment for zebec network price prediction.

Final Thoughts

Predicting the price of Zebec Network, or any cryptocurrency for that matter, is challenging. However, by understanding the underlying technology, analyzing market trends, and employing a combination of fundamental and technical analysis, you can develop a more informed perspective. It’s crucial to remember that responsible investing involves managing risk, diversifying your portfolio, and always doing your own research. The future of Zebec Network, and its price, will be shaped by adoption, innovation, and the broader crypto landscape. So stay informed, stay curious, and always approach price predictions with a healthy dose of skepticism.